What’s new in food trade? A collection of items.

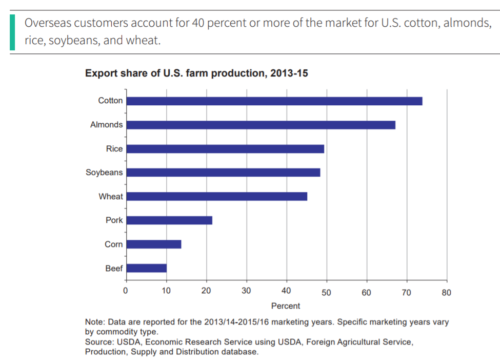

Food trade is always a big issue, but it’s one I have a hard time keeping up with. It’s in the news right now because President-elect Trump is threatening to increase tariffs with unsettling effects. His vows, vows to slap new tariffs on U.S. trading partners on Day One, according to Politico, “has sent ripple effects through the U.S. agricultural industry, which relies on exports to boost profits for vital commodity crops like soy and corn.”

On top of that, the USDA predicts a record $45.5 billion deficit in food trade this year: U.S. Agricultural Exports in Fiscal Year 2025 Forecast at $170.0 Billion; Imports at $215.5 Billion.

As Agricultural Dive explains,

An already record agricultural trade deficit in the United States is expected to get even bigger, the Agriculture Department said Tuesday. The U.S. farm trade deficit in fiscal year 2025 is on track to reach $45.5 billion, according to an updated USDA outlook. Government analysts were previously forecasting a $42.5 billion deficit in August….

While U.S. producers have been able to modestly increase exports of livestock, dairy, corn and sorghum since the USDA’s August forecast, trade of other major commodities — namely cotton and soybeans — has declined. Crop farmers have been hit the hardest by a decline in global prices and are expected to bear the brunt of the widening trade deficit….

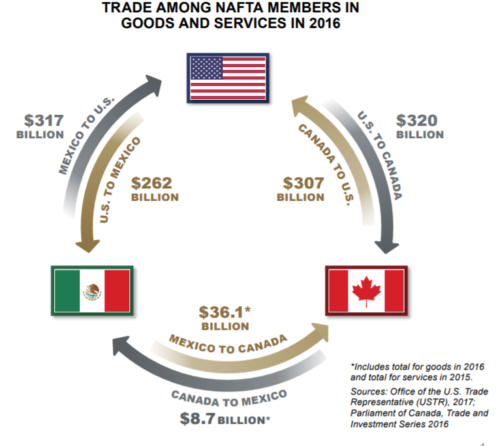

Trade with two of the U.S.′ biggest markets faces additional risks next year as President-elect Donald Trump threatens 25% tariffs on Canada and Mexico. Trade with both countries has soared in recent years, with Mexico replacing China as the top U.S. agricultural market.

Much of the deficit is our fault, apparently. We have a voracious demand for “ever-larger amounts of imported fruits, vegetables, wine, alcohol, coffee, and beef.”

The issue of Mexico as our top market raises questtions about the GMO corn we send there. US Right to Know has published or reproduced a series of articles on this issue.

- GM corn and glyphosate science: Documents from Mexico-US trade dispute

- New scientific analyses underpin Mexico’s restrictions on GM corn and glyphosate due to health risks

- Mexico’s Scientfic Dossier on GMO Corn and its Effects

- Leading scientist defends Mexico’s food sovereignty from GM corn and glyphosate

The trade dispute works both ways: US suspends Mexico cattle imports after New World screwworm detected: The United States has relied on livestock from the country as ranchers struggle to rebuild depleted cattle herds.

Finally, for now, a new FAO report offers guidance and data on integrating nutrition goals into food trade policies: The State of Agricultural Commodity Markets 2024.

While trade liberalization has numerous benefits for food security, questions linger about whether it is conducive to healthy diets. An analysis for SOCO 2024 using FAO’s Cost and Affordability of a Healthy Diet indicator found that higher import tariffs are associated with higher food prices irrespective of the healthy qualities of the foods, indicating that, in general, trade openness does not have a disproportionate effect on high-energy low-nutrition foods.