Not sure about soda taxes? Read this!

The New York City Health Department has produced a handy guide – a tool kit, actually – to soda tax legislation. It explains the rationale, reviews the evidence supporting the use of such taxes, provides fact sheets, and answers Frequently Asked Questions. For the academics among us, it provides loads of reference citations. Take a look and put it to good use!

Update January 30: FoodNavigator.com did a report on reaction to the soda tax bill, “Fresh New York soda tax plans stir up the obesity debate.” It’s got a great quote from the American Beverage Association:

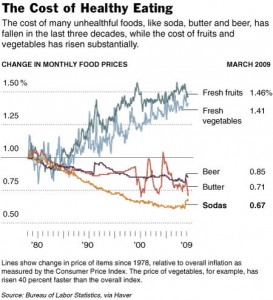

What’s particularly disconcerting about this proposal is that the tax on a 12-pack of non-alcoholic beverages, like soft drinks, would be more than 9 times higher than the state tax on a 12-pack of alcoholic beverages, like beer.

This, as you might expect, has stirred up some counter-proposals, the most obvious being to increase the tax on alcoholic beverages. Now that ought to generate some additional revenue!

While we are on the subject of alcohol, a forthcoming paper by Barry Popkin is said to have some interesting trend data:

Among adults aged 19 and over, SSB [sugar-sweetened beverage] consumption had almost doubled from 64 to 142kcal/day and alcohol consumption had increased from 45 to 115 kcal/day [from 1977-2006].

Popkin’s conclusion: “The consumer shift towards increased levels of SSBs and alcohol, limited amounts of reduced fat milk along with a continued consumption of whole milk, and increase juice intake represent issues to address from a public health perspective.”