WHO calls for soda taxes

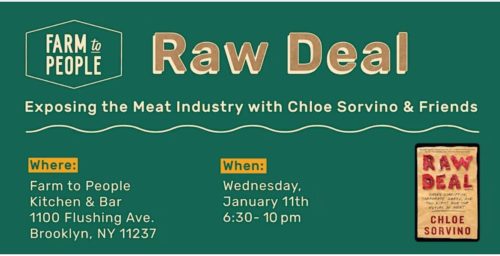

For your calendar today at 6:30 pm EST:

*****

The World Health Organization has taken a major step: it calls on member countries to tax sugar-sweetened beverages.

“Taxes on sugar-sweetened beverages can be a powerful tool to promote health because they save lives and prevent disease, while advancing health equity and mobilizing revenue for countries that could be used to realize universal health coverage,” said Dr Ruediger Krech, Director of Health Promotion at WHO.

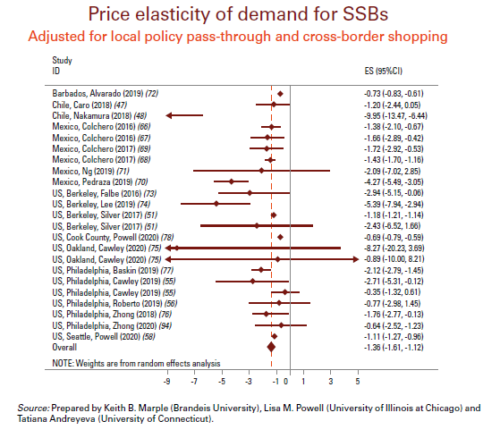

SSB, tobacco, and alcohol taxes have proven to be cost-effective ways of preventing diseases, injuries, and premature mortality. SSB tax can also encourage companies to reformulate their products to reduce sugar content.

More than that, WHO has produced a manual on how to develop and implement SSB taxation policies.

This tax manual is a practical guide for policy-makers and others involved in SSB tax policy development to promote healthy diets and populations. It features summaries and case studies of SSB global taxation evidence, and provides support on the policy-cycle development process to implement SSB taxation — from problem identification and situation analysis through policy design, development and implementation to the monitoring and evaluation phase. Additionally, the manual identifies and debunks industry tactics designed to dissuade policy-makers from implementing these taxes.

SSB taxes can be a win-win-win strategy: a win for public health (and averted health-care costs), a win for government revenue, and a win for health equity.

The manual summarizes everything anyone needs to know to justify taxes and to craft policy. Get to work!

********

For 30% off, go to www.ucpress.edu/9780520384156. Use code 21W2240 at checkout.