Soda industry sues Santa Cruz over its new soda tax

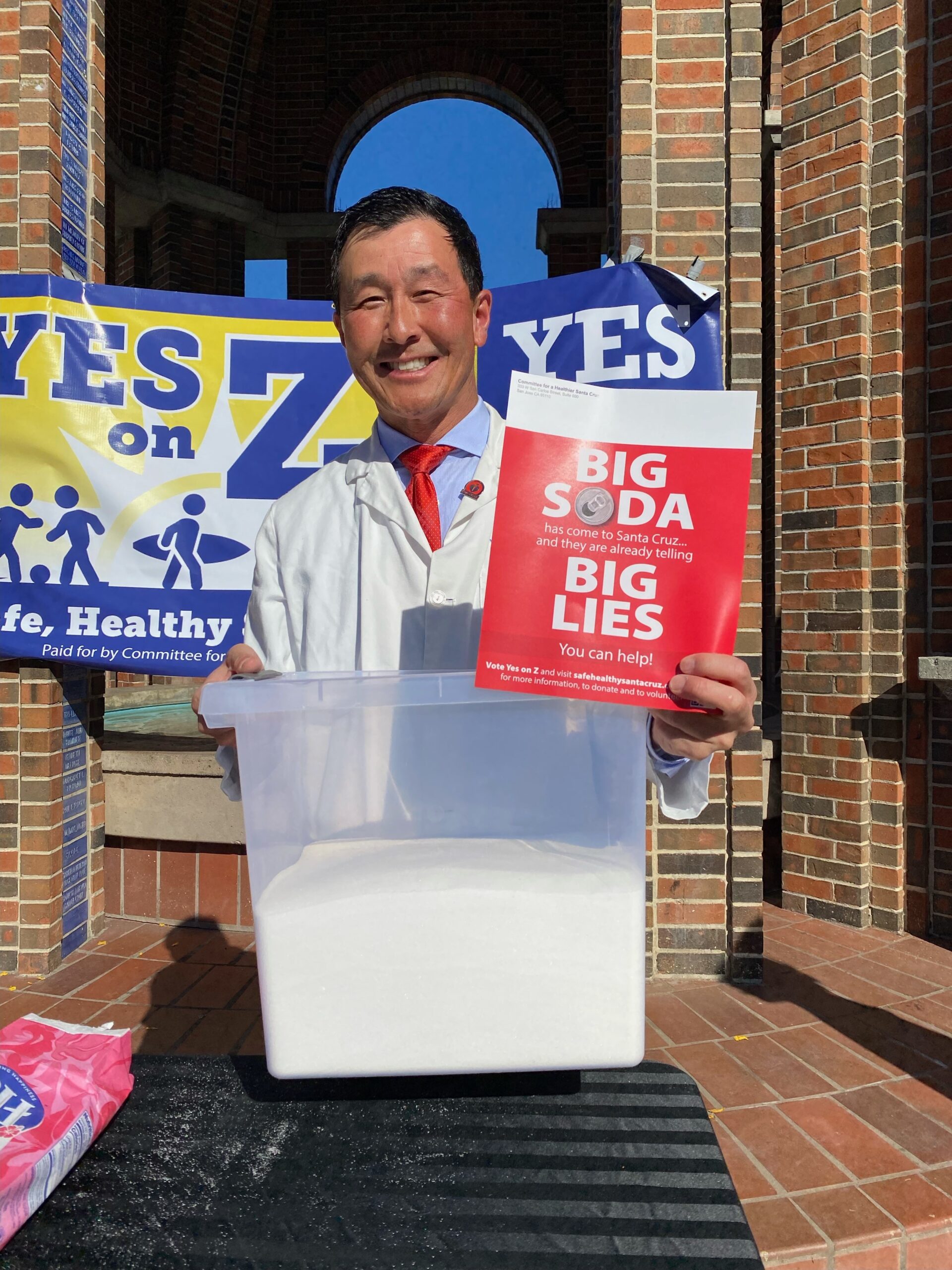

A few months ago, Santa Cruz, a small town on California’s coast south of San Francisco, and the home of the University of California Santa Cruz, passed a tax on sugar-sweetened beverages.

It did this, even though the soda industry had gotten the state legislature to ban such taxes until 2031 by passing the “Keep Groceries Affordable Act in 2018.”

But further legislation and court rulings allowed charter cities to pass local taxes to raise revenues.

But now, the soda industry and its allies are suing Santa Cruz on the basis that the law passed because its purpose was not just revenue, but to discourage soda consumption. The text of the lawsuit is here.

Santa Cruz is engaging in an act of local rebellion: “on matters of soda, city residents and leaders are standing up to the state and to beverage companies. Come and get us if you like, they say. We won’t compromise on democracy and local sovereignty.”

If you want to understand what is at stake, take a look at the plaintiffs in this case. They include the American Beverage Association, of course but also the

- California Grocers Association

- California Hispanic Chambers of Commerce

- California Alliance of Family-Owned Businesses

- California Chamber of Commerce

- California Fuels and Convenience Alliance

A representatve of the California Hispanic Chambers of Commerce explained why it was joining the suit.

“Through representing the interests of over 950,000 Hispanic-owned businesses in California, we see first-hand the challenges faced by small, community-based businesses that are up against inflation, labor shortages and the extraordinary high cost of doing business in California,” said Julian Cañete, president of the California Hispanic Chambers of Commerce. “Santa Cruz illegally sidestepped the state legislature’s popular and much-needed preemption of grocery taxes to impose new costs on working families and local Hispanic-owned businesses. It must be overturned.”

As is evident from the soda industry’s attempts to spare no expense in fighting soda taxes, the taxes must be highly effective in reducing sales.

Never mind public health. Selling sodas is what counts.

Addition