Crop insurance: some thoughts

When I taught a course on the farm bill some years ago, students were stunned by how crop insurance works. They wondered how they could break into that business.

Sixteen insurance companies write policies for farmers. The federal government pays 62% of the premiums to the tune of about $8 billion per year. Farmers pay 38%.

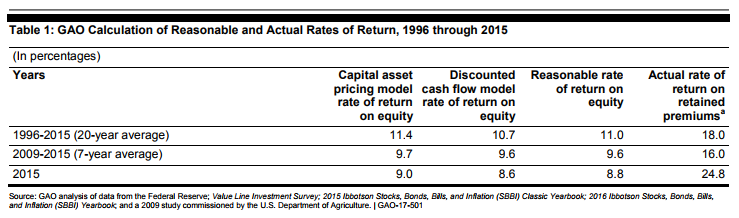

The lucky insurance companies make out like bandits under this system—an average rate of return of 24.8%. The Government Accountability Office, no surprise, thinks this exceeds market rates and needs to be readjusted.

Farmers need crop insurance, no question.

But in the wake of Hurricane Irma, we learned that farmers who grow fruits, vegetables, and nuts—in USDA jargon, “specialty crops”—feel that they cannot afford it.

Historically, the program has covered corn, soybean, and other large-scale commodities—about 85% of such acres are covered.

But crop insurance now covers 73% of fruit and tree nut acreage but only 32% percent of vegetable crops, accounting for 8% of premiums.

According to a Risk Management report on specialty crops, insurance covers virtually all of Florida’s sugarcane, cotton, and citrus, but only about half of fresh tomatoes, sweet corn, and bell peppers, and none of fresh beans.

Obviously, plenty is wrong with the crop insurance program. Will the 2018 farm bill do anything to fix it?

According to Politico Pro Agriculture, Secretary Sonny Perdue told reporters that the he favors restructuring the program but that the crop insurance program should not promise farmers profitability.

What about profitability for the crop insurers? The GAO recommends reducing this industry’s profits to market rates. That should leave plenty of money to help specialty crop farmers.