The Upcoming Farm Bill: What’s Needed (Courtesy of Civil Eats)

I try to keep up with what’s going on with the Farm Bill, up for renewal soon. I thought this Civil Eats post by Lisa Held was the best thing I’d seen on it in ages, and got permission from Civil Eats to re-post it [To subscribe to Civil Eats—I’m on their advisory committee—click here].

To all of what follows, amen.

This Farm Bill Could Reshape the Food System. Here Are 10 Proposals at the Center of the Fight.

In this week’s Field Report, an update on how lawmakers are gearing up for a food-and-ag sprint when they return to D.C. in September. Plus: A smaller-than-expected Gulf of Mexico dead zone, and updates on the Better Chicken Commitment.

While the House and Senate Agriculture Committees have been holding hearings and listening sessions since the beginning of the year, progress has repeatedly stalled amid fights over the debt ceiling and appropriations bills that still have not been finalized.

Now, the deadline of September 30 looms large—and will almost certainly be missed.

Before members of Congress left for their August break, they initiated a flurry of activity in advance of what will likely be a sprint toward writing and then passing the legislation that shapes America’s food and agriculture system. Members of the House Ag Committee held listening sessions with farmers in Maine and Minnesota.

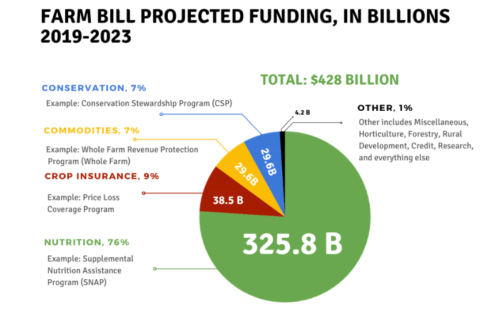

Then, Democrats sent a strongly worded letter to House Speaker Kevin McCarthy (R-California) urging Republicans to drop their attempts to further restrict Supplemental Nutrition Assistance Program (SNAP) benefits, since those efforts would hold up the bill even longer and hurt low-income Americans struggling from the impacts of the pandemic and high food prices.

At the same time, lawmakers rapidly introduced dozens of new marker bills, which are smaller pieces of legislation that are considered for inclusion in the larger farm bill package. In the bills, they proposed a wide range of changes, from more support for urban agriculture and small farms to new programs for farmer conservation education to improvements to the nation’s supply chain infrastructure and provisions that would expand SNAP access for college students and Tribes.

There are also bills to help farmers install renewable energy systems and to give contract growers more power to stand up to the corporations they work for. The list is overwhelmingly long and adds to dozens of marker bills introduced earlier this year, many of which we’ve already covered.

Here, we share 10 important new marker bills you should know about before Congress returns next month and the pace of negotiations accelerates. One detail in particular might surprise you: Many—if not most—have some measure of bipartisan support.

1. Expand Access to Fresh Fruits and Vegetables

Representatives Rick Crawford (R-Arkansas) and Dan Kildee’s (D-Michigan) GusNIP Expansion Act would strengthen the popular Gus Schumacher Nutrition Incentive Program (GusNIP) in a number of ways, while another marker bill proposes increasing the program’s funding. GusNIP funds programs that give SNAP users access to more fruits and vegetables, especially through farmers’ market matching and produce prescription programs. Unlike SNAP, it generally garners bipartisan support, since it focuses on healthy food and directs more dollars directly to farmers. More than 600 farm, nutrition, and public health organizations support expanding the program.

2. Track SNAP Purchases

Changes to SNAP always attract controversy, and the SNAP Nutrition Security Act falls into that category. Introduced by Senators Cory Booker (D-New Jersey) and Marco Rubio (R-Florida), the bill would require the USDA to track and report on what SNAP users are buying to assess whether the program is helping low-income Americans improve their nutrition. Many public health groups support it. But while it doesn’t restrict what SNAP users can buy, some advocacy groups oppose it because they believe that the data could be used to restrict purchases in the future. Rubio also introduced a separate marker bill that would change SNAP rules so that users couldn’t use SNAP dollars to buy unhealthy foods such as soda, candy, and ice cream.

3. Prevent States From Regulating Farm Animal Welfare

In May, after years of legal challenges brought by the pork industry, the Supreme Court declined to overturn a California law that prohibits selling pork that comes from systems that hold pigs in confining cages. Now, a group of lawmakers are trying to use the farm bill to overturn that law—and prevent other states from regulating farm animal welfare. Senator Roger Marshall (R-Kansas) and Representative Ashley Hinson (R-Iowa) led the introduction of the Ending Agricultural Trade Suppression (EATS) Act, which is supported by industrial agriculture groups like the National Pork Producers Council and the National Cattlemen’s Beef Association.

At the same time, the Organization for Competitive Markets led a group of farmers and ranchers representing multiple producer groups to lobby against the bill, while leaning into the argument that it would hurt farmers and increase China’s control over the pork industry (since Smithfield, the nation’s largest pork producer, is owned by a Chinese company). Meanwhile, Harvard’s Animal Law and Policy Program released a report that concluded the EATS Act is likely unconstitutional and would have far-reaching consequences that could threaten “states’ rights, consumer safety, and farmers’ livelihoods.”

4. Limit Commodity Payment Abuse

5. Increase Land Access for Young Farmers

America is staring down a farmer aging crisis, and the National Young Farmers Coalition has identified land access as the number one challenge facing young farmers. In response, Senator Tina Smith (D-Minnesota) introduced the Increasing Land Access, Security, and Opportunities Act in July. It aligns with a House version of the bill introduced in June and would direct funding toward new programs that help young farmers—and especially young farmers of color—afford and get access to land.

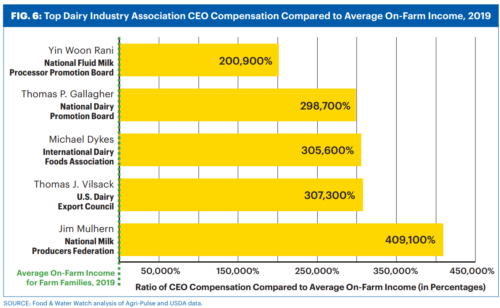

6. Reform the Checkoff System

Checkoff programs are meant to promote the interests of farmers that pay into them by promoting their products. (“Got milk?” is the most famous example.) But many farmers feel that checkoffs have moved away from their original intent and often misuse funds and lobby against the interests of members. The Opportunities for Fairness in Farming Act would reform the federal checkoff program by creating more transparency around how the money is spent and banning the use of funds for lobbying. Senator Mike Lee (R-Utah) and Representative Nancy Mace (R-South Carolina) led its introduction alongside a list of lawmakers in both chambers on both sides of the aisle.

7. Make USDA Farm Lending More Equitable

Kirsten Gillibrand (D-New York) introduced the Fair Credit for Farmers Act, which would improve accountability and transparency within Farm Service Agency lending in an attempt to better ensure that historically underserved farmers and ranchers receive equal treatment. The National Family Farm Coalition and Rural Advancement Foundation International support this bill.

8. Help Small Farms Access Crop Insurance

Crop insurance only works well for large, commodity farms, since most smaller, diversified farms don’t grow enough of a single crop to make it worth the investment. In the 2014 Farm Bill, Whole Farm Revenue Protection was created as a solution, but flaws in the program have prevented most farmers from signing up. Senator Brown’s Whole Farm Revenue Protection (WFRP) Program Improvement Act, backed by the National Sustainable Agriculture Coalition, attempts to fix that by streamlining the application process, making changes that reward diversification, and providing incentives and training to crop insurance agents.

9. Reduce Environmental Impact of Animal Agriculture

Two California Democrats—Senator Alex Padilla and Representative Jim Costa—led the introduction of the Converting Our Waste Sustainably (COWS) Act. That makes sense, since the bill creates a federal program modeled after a successful initiative in their state. The COWS Act would fund upgrades to manure management systems on dairies and other livestock operations, such as implementing composting instead of liquid lagoons and increasing the time cows spend on pasture, to prevent water pollution and reduce methane emissions. (Whatever happens with the legislation, Padilla and Costa definitely win for the most successful acronym.)

10. Invest in Organic Farming Research

Read More from Civil Eats:

The Farm Bill Really Matters. We Explain Why

Former SNAP Recipient Calls for Expanded Benefits in Next Farm Bill

Op-Ed: We Need a New Farm Bill for My Iowa Farm and Beyond

Climate Change Is Walloping U.S. Farms. Can the Farm Bill Help?Lisa Held is Civil Eats’ senior staff reporter. Since 2015, she has reported on agriculture and the food system with an eye toward sustainability, equality, and health, and her stories have appeared in publications including The Guardian, The Washington Post, and Mother Jones. In the past, she covered health and wellness and was an editor at Well+Good. She is based in Baltimore and has a master’s degree from Columbia University’s School of Journalism. Read more >