Weekend reading: Taxing Sugar-Sweetened Beverages

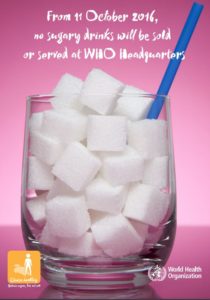

Here’s a report from the World Health Organization on the effects of taxing sugar-sweetened beverages.

The study:

Consumption of SSBs is associated with increased risk of overweight and obesity (5), cardiovascular events (6), hypertension (7) and diabetes (8). There is now substantial evidence that SSB taxes can both discourage consumption and encourage reformulation (9,10). SSB taxes have also been found to have positive impacts on population weight and to potentially have greater health benefits among lower socioeconomic populations (11,12)….This study takes a policy analysis lens to studying SSB tax adoption and implementation in the WHO European Region. The focus was on the politicoeconomic and stakeholder dynamics in cross-sectoral policy-making, as well as considering adaptation in policy design.

https://www.euro.who.int/en/health-topics/disease-prevention/nutrition/publications/2022/sugar-sweetened-beverage-taxes-in-the-who-european-region-success-through-lessons-learned-and-challenges-faced-2022

https://www.euro.who.int/en/health-topics/disease-prevention/nutrition/publications/2022/sugar-sweetened-beverage-taxes-in-the-who-european-region-success-through-lessons-learned-and-challenges-faced-2022

- Be adapted to a country’s legislative, fiscal, economic and health context.

- Be designed and implemented through collaboration between finance and health policy-makers.

- Take revenues into consideration.

- Expect opposition from industry.

On this last point, the report says:

SSB taxes were strongly opposed by actors in the food and beverage industry in all the study countries, before and after implementation. Industry made strong public statements regarding the negative economic impact that the tax would have on industry, particularly in relation to employment. In Finland, France, Hungary, Ireland and Portugal, they also argued that the tax would be regressive and, therefore, have a negative impact on consumers. In Belgium, Finland, France and Hungary (notably, these were earlier taxes), industry actors raised concerns that the tax singled out beverages and/or the beverage industry for differential taxation. Industry actors also presented a range of arguments regarding the taxes being ineffective and poorly designed.

Soda tax advocates need strategies to counter this opposition. Plenty are available. See the toolkit at Healthy Food America, for example.