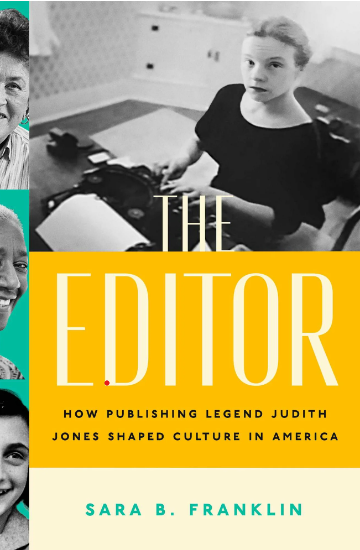

Sara B. Franklin. The Editor: How Publishing Legend Judith Jones Shaped Culture in America. Atria Books, 2024. 316 pages.

I badly wanted to read this book. Sara Franklin got her doctorate in Food Studies in my NYU department and I met Judith Jones several times in the 1990s and 2000s (she died in 2017).

Judith Jones is famous in food circles for rescuing Julia Child’s manuscript for Mastering the Art of French Cooking and getting Knopf to publish it.

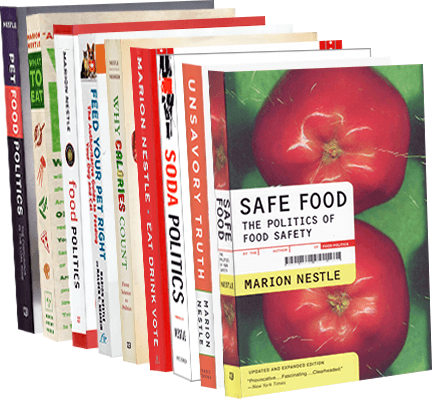

But the best way to understand her impact is to take a look at the jaw-dropping list of authors she edited; it takes up two and a half double-columned pages, and includes poets (WH Auden, Sylvia Plath, Sharon Olds) and writers (Andre Gide, John Hersey, Langton Hughes), as well as a breathtaking list of food writers: MFK Fisher, Marion Cunningham, Elizabeth David, Scott Peakock, Elisabeth Rosin, Jeffrey Steingarten, and on and on. And, oh yes, Anne Frank.

The story here is of a woman who began her editing career in 1949 when the best women could aspire to was secretarial work. She worked her way up through the system, but did not fight it and was always treated as someone who didn’t matter much, despite that incredible list of authors, many of them deeply devoted to Judith for what she did for them.

As an author, I can tell you that a good editor is a treasure and she was a terrific one. She got her authors to clarify, explain, focus, and make their books readable, understandable, and enjoyable for wide audiences. This takes insight and the ability to inspire authors to do their best work—genuine talent. It also requires stepping back and letting the authors shine. This book details Judith’s way of staying in the background, not always to her advantage.

Sara Franklin got to know Judith Jones, was given access to her papers, and conducted loads of interviews as the basis for this book. She tells the story of one woman’s career, but sets it against the background of changes in society and in the food world since the 1950s and in the lives of the authors she edited—the era that I too have lived through and these are people I know, explaining why I so enjoyed reading this.

I especially like the way Sara weaves herself into the book but mostly lets Judith speak for herself. An excerpt:

“Dick [Judith’s husband] didn’t take criticism well,” Judith told me, “And I thought it awkward to play the two roles,” editor and wife at once, “so I just shut up. I would have liked more back and forth, but people have their hang-ups”…Judith had been caught off guard by how overwhelmed she’d become by family life, and the perpetual juggle of working motherhood. Keeping up with the demands of her career while remaining attentive and available to Dick and the children, Judith found, was an almost impossible balancing act, with “so much,” she remarked, “dumped on the woman.” With no models to look to, Judith was flying blind. “I hadn’t really thought about it,” she told me. “It just seemed natural.”

As I said, a classic woman’s story of the era.

Much of the book describes Judith’s acquisition of important books and the ways she worked with their authors. I wish I had had the chance to work with her. I know I’m not alone in thinking that would have been an honor and a privilege.

Sara’s book is terrific. And we are so proud of her.

The book was reviewed in the New York Times: She Was More Than the Woman Who Made Julia Child Famous: In “The Editor,” Sara B. Franklin argues that Judith Jones was a “publishing legend,” transcending industry sexism to champion cookbooks — and Anne Frank.