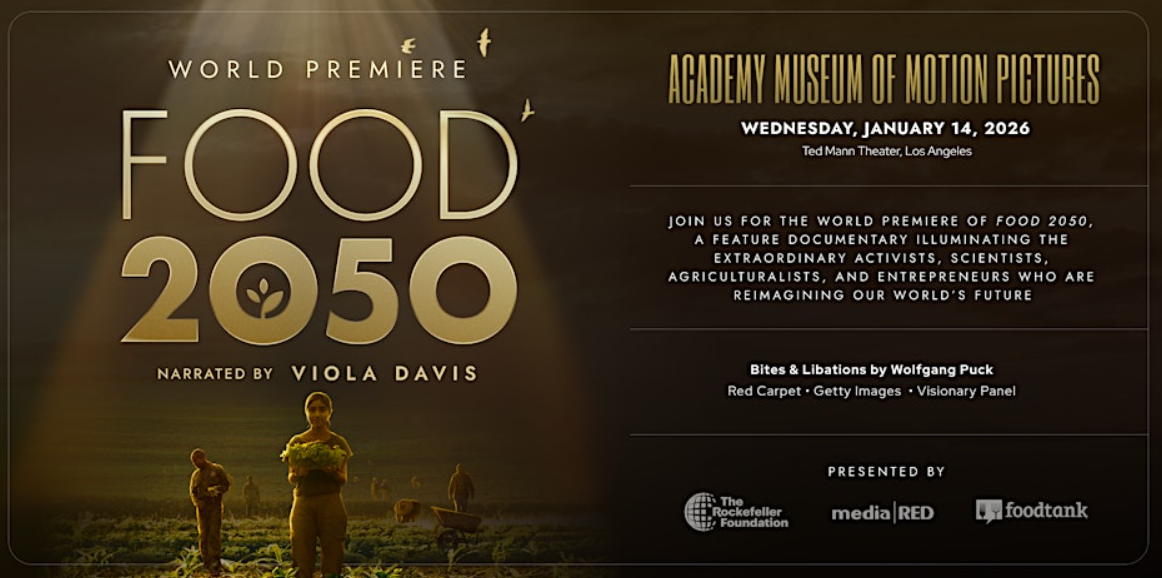

I’m on the visionary panel. To register, click here.

Worried about the potential personal and economic costs of obesity? Never mind. It’s time to view obesity as a business opportunity.

As the press release for a new research report from Bank of America Merrill Lynch, Globesity—The Global Fight Against Obesity, points out:

Increasing efforts to tackle obesity over the coming decades will form an important new investment theme for fund managers…Global obesity is a mega-investment theme for the next 25 years and beyond…The report…identifies that efforts to reduce obesity is a “megatrend” with a shelf-life of 25 to 50 years…BofA Merrill Lynch analysts across several sectors have collaborated to identify the sectors and companies developing long-term solutions.

Given the worldwide increase in obesity, its high prospective costs, and the ever-present threat of government regulation, the report identifies more than 50 global stocks that provide investment opportunities for fighting “globesity.” These fall into four categories:

Well, that’s one way to look at it. Public health, anyone?