Join Health Affairs for a virtual conversation between me and Angela Odoms-Young of Cornell University discussing the evolution of US food and nutrition policy, the current policy landscape, and thoughts on what lies ahead. It’s at 1:00 p.m. EDT. To join the Webinar, click here.

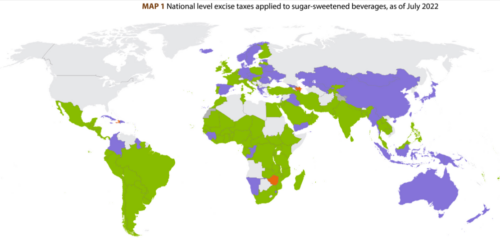

The World Health Organization: Health Taxes (e.g., on Sugar-Sweetened Beverages)

The UN’s World Health Organization (WHO) has long led efforts to tax unhealthy products, starting with tobacco.

WHO describes its health tax efforts here.

It recently issued Global report on the use of sugar-sweetened beverage taxes, 2023.

The report finds that 108 countries have some kind of tax on sugar-sweetened beverages.

But, it finds

Less than a quarter of countries surveyed account for sugar content when they impose taxes on these non-alcoholic beverage products. Countries with a sufficiently strong tax administrative capacity are encouraged to tax beverages based on sugar content, as it can encourage consumers to substitute with alternatives that have lower sugar content as well as incentivize the industry to reformulate beverages to contain less sugar.

One of its major overall findings:

Among its conclusions are these:

- Existing taxes on SSBs could be further leveraged to decrease affordability and thereby reduce consumption. While other perspectives and competing factors have to be accounted for when designing taxation policies, the protection of health should be a key consideration, particularly considering the health and economic burden associated with obesity and diet-related NCDs.

- This report concludes that excise taxes on SSBs are not currently being used to their fullest potential. Improving tax policy and increasing taxes so that SSBs become less affordable should be pursued more systematically by countries in order to effectively reduce consumption and prevent and control diet-related NCDs, including obesity and dental caries.

Here’s the evidence. Get to work!

Resoures