I’m on the visionary panel. To register, click here.

Politics, as they say, makes strange bedfellows, and here I am carefully reading the Cato Institute’s most interesting analysis of farm insurance:Farm Bill Sows Dysfunction for American Agriculture (thanks to Stephen Zwick for sending).

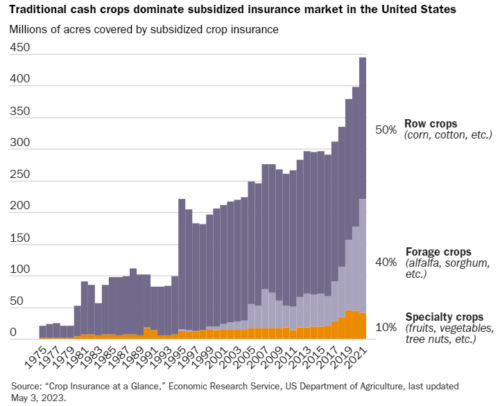

“Agriculture is a uniquely coddled industry with the USDA providing more than 150 different programs for the industry, 53,000 farm‐related employees in the USDA, and 2,300 USDA agriculture offices across the country,” said Chris Edwards, the Kilts Family Chair in Fiscal Studies at the Cato Institute….Tax dollars cover about 60 percent of the insurance premiums that farmers pay, amounting to a record $11.6 billion in 2022, as noted in Figure 1. Total insured acreage has jumped from 206 million acres in 2000 to 493 million in 2022, increasing the taxpayer cost for premium subsidies sixfold in that time frame. The government also compensates the private insurance companies that participate in the program for their administrative costs, which are projected to be about $2 billion per year from 2024 through 2033.

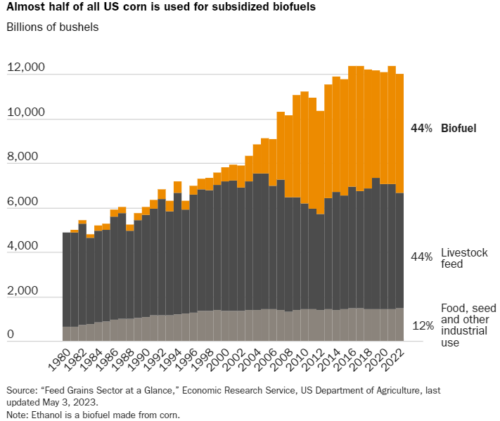

The graphics are particularly instructive.

This one is an updated version of what happens to corn grown in the US—biofuel, animal feed, industrial use and hardly any for food.

This one shows which crops get taxpayers’ money.

The Cato Institute does not like this system, and neither do I.

This system needs an overhaul, big time.

Will we get that in the forthcoming farm bill? It’s a self-perpetuating system, alas.