Join Health Affairs for a virtual conversation between me and Angela Odoms-Young of Cornell University discussing the evolution of US food and nutrition policy, the current policy landscape, and thoughts on what lies ahead. It’s at 1:00 p.m. EDT. To join the Webinar, register here.

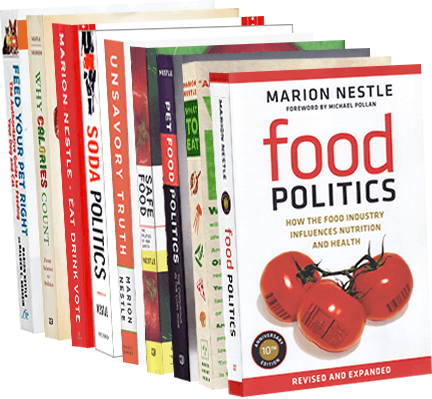

by Marion Nestle

Oct

9

2019

Sugar reduction in the UK: Taxes work, voluntary does not

I was alerted to this story by the FoodNavigator-USA headline: Sugar content in soft drinks cut by nearly a third as voluntary efforts fall way off target.

Public Health England’s latest progress report on the food and drink industry’s sugar cutting efforts reveal significant changes in areas where the sugar tax applies, but a disappointing lack of progress with the voluntary sugar reduction programme.

The Year 2 progress report finds:

- The sugar in taxed drinks affected by the Soft Drinks Industry Levy (SDIL) decreased by 28.8% between 2015 and 2018.

- For non-taxed products, the reduction in sugar was only 2.9%.

- Total sugar increased by 2.6%: the largest increases were for ice cream, candies, sweet spreads, and cookies.

Moral: if you want companies to reduce sugar in their products, tax them.