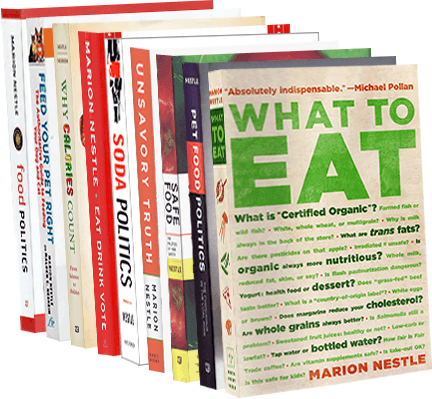

Join NYU Libraries for an insightful discussion with some of our most esteemed panelists about how the conversation, study, and action around food has evolved over the last two decades. Together, we’ll reflect on 20 years of the Critical Topics in Food event series and examine the role that thoughtful community gatherings like these have played in shaping our collective dialogue about food. The Critical Topics in Food event series is a partnership between NYU Special Collections, NYU Steinhardt Department of Nutrition & Food Studies, and Clark Wolf.

Soda taxes: politics vs. public health

By analogy with cigarettes, taxes on sodas might discourage people—especially young people—from consuming sugary drinks. This might help with weight issues.

According to a new analysis by USDA economists,

A tax-induced 20-percent price increase on caloric sweetened beverages could cause an average reduction of 37 calories per day, or 3.8 pounds of body weight over a year, for adults and an average of 43 calories per day, or 4.5 pounds over a year, for children. Given these reductions in calorie consumption, results show an estimated decline in adult overweight prevalence (66.9 to 62.4 percent) and obesity prevalence (33.4 to 30.4 percent), as well as the child at-risk-for-overweight prevalence (32.3 to 27.0 percent) and the overweight prevalence (16.6 to 13.7 percent).

Soft drink companies know this all too well. Hence, intense industry lobbying. In the case of New York State, the lobbying succeeded. Soda taxes are history (for now).

As the New York Times explains:

Final lobbyist filings are not yet in, but estimates of the amount spent…range from $2.5 million, by Mr. Finnegan’s count, to $5 million, by the beverage industry’s count. The American Beverage Association spent $9.4 million in the first four months of the year to oppose New York’s soda tax, according to a search of public lobbying records by the New York State Healthy Eating and Physical Activity Alliance. Most of the money was spent on advertising, media and strategy.

This is a setback, but probably temporary. Sooner or later, soda taxes will come. Bring on the research!

Addition, July 5: Harvard researchers have just published a paper in the American Journal of Public Health showing that raising the price of sodas in a hospital cafeteria does indeed discourage sales.